Aksar log term insurance ke baare mein sochte hi nahi.

Aur jo sochte bhi hain, woh bolte hain:

“Shaadi ke baad lenge…”

“Bachche ho jaayenge tab dekhenge…”

“Abhi toh young hoon, baad mein le lenge…”

Yahi soch logon ko lakhs ka nuksaan kara deti hai.

Is blog mein hum simple language mein samjhenge:

- Term insurance kab lena chahiye

- Jaldi lene ka real financial fayda

- Aur late lene par kitna bada loss hota hai (with calculation)

Sabse Pehle Ye Samajhiye: Term Insurance Hai Kya?

Term insurance koi investment ya return wala product nahi hai. Ye ek pure protection plan hai.

Agar aap earning member hain aur aapke saath kuch ho jaata hai, toh term insurance aapki family ko lump sum amount deta hai — ₹50 lakh, ₹1 crore, ₹2 crore, jitna cover aapne liya ho.

Ye paisa aapki family ke:

- Home loan

- Rent / EMI

- Bachchon ki education

- Parents ki medicines

- Daily expenses

sab sambhalta hai.

Simple words mein:

👉 Term insurance aapki income ko replace karta hai.

Ab Aate Hain Main Question Par: Term Insurance Kab Lena Chahiye?

Short Answer:

👉 Jitna jaldi ho sake, utna achha.

Lekin chaliye isko sirf advice nahi, calculation ke saath samajhte hain.

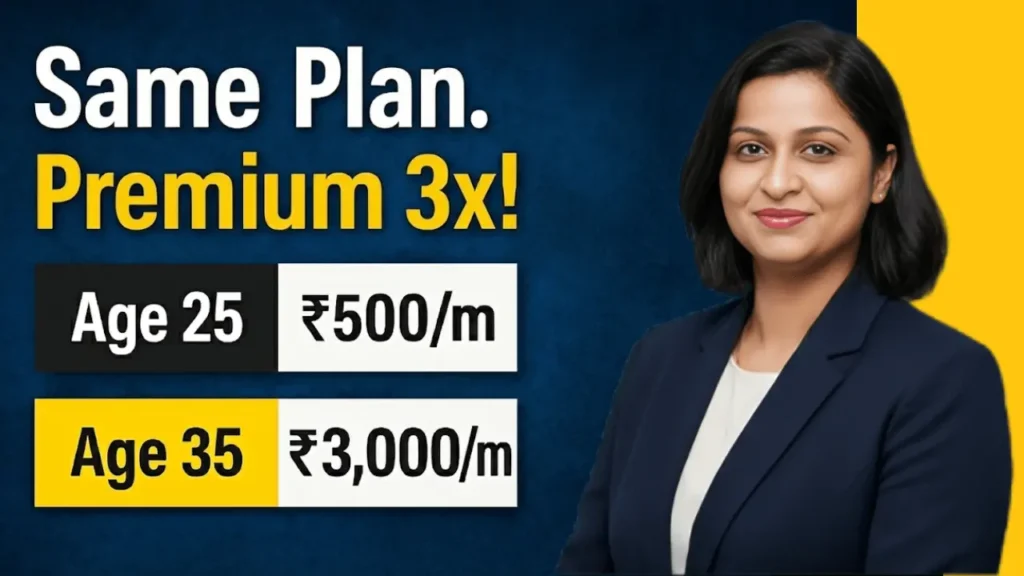

Age 25 vs Age 35 – Real Premium Comparison

🔹 Case 1: Agar Aap 25 Saal Ki Umar Mein Term Insurance Lete Ho

- Monthly premium: ₹500

- Yearly premium: ₹6,000

- Policy term: 25 se 65 saal = 40 years

Total premium paid:

₹6,000 × 40 = ₹2,40,000

🔹 Case 2: Agar Aap 35 Saal Ki Umar Mein Wahi Same Plan Lete Ho

- Monthly premium: ₹3,000

- Yearly premium: ₹36,000

- Policy term: 35 se 65 saal = 30 years

Total premium paid:

₹36,000 × 30 = ₹10,80,000

Ab Zaraa Difference Dekhiye

- Age 25 total cost: ₹2.4 lakh

- Age 35 total cost: ₹10.8 lakh

👉 Sirf 10 saal delay karne par: ₹8.4 lakh zyada payment

Aur shocking baat yeh hai:

- Zyada paisa dene ke baad bhi

- Aapko 10 saal kam coverage milti hai

Same plan.

Same company.

Bas age badhi — aur cost 3x ho gayi.

Late Lene Ka Ek Aur Risk: Health Issues

35 ke baad aksar logon ko:

- BP

- Thyroid

- Sugar

- Weight issues

jaise problems shuru ho jaati hain.

Insurance companies:

- Extra loading laga deti hain (premium aur badh jaata hai)

- Ya kabhi-kabhi policy reject bhi kar deti hain

Iska matlab:

👉 Aap late bhi le rahe ho

👉 Mehenga bhi le rahe ho

👉 Aur guarantee bhi nahi hai ki policy milegi

Isliye Experts Kya Kehte Hain?

Expert advice simple hai:

- Term insurance young age mein lo

- Premium kam hota hai

- Approval easy hota hai

- Coverage zyada milta hai

- Aur aap apna premium long term ke liye lock kar lete ho

Toh Ideal Age Kya Hai?

- Best age: 23–30 years

- Agar 30 cross ho chuka hai, toh bhi aur delay mat karo

- Shaadi, bachche, loan ka wait mat karo

Agar aap earning member ho — aapki family already aap par depend karti hai, chahe aap maanta ho ya nahi.

Ek Simple Rule Yaad Rakhiye

Term insurance zarurat padne se pehle li jaati hai, baad mein nahi.

Kyuki jab zarurat padti hai, tab ya toh mehenga ho jaata hai, ya milta hi nahi.

Final Thoughts

Term insurance lene ka best time “kal” nahi hota.

Best time hota hai — aaj.

Aaj aap:

- Kam premium doge

- Zyada coverage paoge

- Apni family ka future secure karoge

Need Help?

Main hoon Harsha, Insurance & Financial Advisor with 11+ years of experience.

Agar aap:

- Apna premium low rate par lock karna chahte hain

- Ya jaana chahte hain ki kitna cover lena chahiye

👉 WhatsApp karein: +91 8882074217

Sahi time par liya gaya decision aapki family ko zindagi bhar ka comfort de sakta hai. 💙